E-Newsletter

April 14, 2022

Last week, the federal government released its budget for 2022-23. They billed it as being prudent and responsible, but advertising can be misleading. The Minister of Finance said it would make life more affordable for Canadians, but I challenge you to find ways this budget will make your life more affordable. As with so many things in this government, the ‘double-speak’ was delivered in gallons.

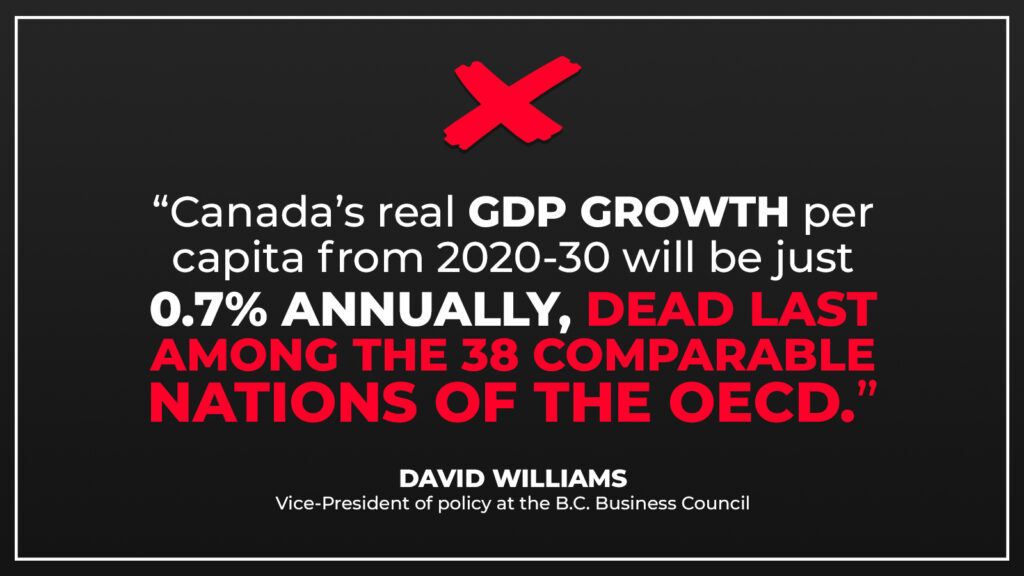

‘Unemployment is near record lows and Canada has gained back 112% of the jobs lost during the pandemic’ – yet, we still need to run a projected $52.4 billion deficit to stimulate the economy.

‘Inflation is making life more expensive for Canadians’ – yet, let’s continue to pump money into program spending to fuel more inflation.

‘Canada has a proud tradition of fiscal responsibility. It is my job to maintain it – and I will.’ – Those words do not match the budget.

I could go on – but the premise of governments running large, structural deficits in periods of strong employment represents an inability to plan for the future. Choices are required, for every decision-maker. Promising expensive

programs today that are predicated on the taxpayers of tomorrow paying the bill is an exercise in moral hazard, and we are seeing the effect of this government’s nonchalance to the country’s finances in our daily lives. Escalating inflation is now upon us – and its arrival is textbook economics. This haphazard approach to Canada’s finances needs to end.

Below I’ve highlighted a few areas of concern. The biggest failure in this budget is its refusal to tackle inflation. Big spending leads to big inflation. Inflation is good for governments – it increases revenues (as we see clearly in the past year’s tax revenues) – but it is bad for ordinary Canadians, and particularly bad for those on low and fixed incomes. The government can’t just keep borrowing and printing money, and expect that demand will not exceed supply and cause prices to rise.

Ruth and I and the rest of our family wish you and yours a Happy Easter, Happy Passover, Happy Vaisakhi, Blessed Ramadan!

HIGHLIGHTS OF THE FEDERAL BUDGET

You will have seen many specific highlights in the news, but here are a few things that concern me:

Deficit: The deficit for this year just ended is $113.8 billion, projected to decline to $52.8 billion next year. Right direction, but that’s still a lot of money. The improvement isn’t due to more prudent spending – it is the result of a windfall of revenues. Inflation and commodity revenues, plus recovering employment and economic activity, improved the government’s revenues by about $85 billion. Of that, about $63 billion was allocated to new spending initiatives, resulting in continued deficit spending.

Debt: The debt is going to rise to $1.14 Trillion dollars. We pay billions every year to service this debt – money we cannot allocate to higher priority spending or tax relief. This year, we will pay about $26.9 billion in service charges. The

Parliamentary Budget Office projects that could reach $40 Billion by 2025-26.

Why does Debt matter: Beyond the “opportunity cost” of servicing debt instead of more important expenditures, interest rates are at historically low levels, so some argue this amount of debt and interest is manageable. However, when interest rates go up – and they will – managing debt becomes more and more expensive. There are no measures in this budget to tackle debt – and every year we run a deficit, that debt grows larger and eats up an increasing percentage of revenues – currently above 6% and projected to exceed 8% by 2025-26.

Debt to GDP Ratio: This government – starting seven years ago – abandoned the idea of a balanced budget as being an appropriate fiscal anchor, and shifted to a metric of Debt to GDP. Frankly, as a financial professional, I think the metric is a smokescreen – and it’s really used to compare debtor nations with other debtor nations – as in, ‘we’re not as bad as them’; however, what’s included in the metric differs by country, so it has always been misleading. In my opinion, it has become a ruse to allow debtor nations to convince people that the continuous accumulation of debt is sustainable, and to distract attention from the problems of greater government debt – which we have experienced, and we ignore at our peril.

Spending and Taxes: Of the $63 billion in new spending, the government projects they will recoup roughly half of that from new taxes on large corporations. They can also count on increased GST revenues: as inflation causes prices to rise, GST revenue also rises; and from increased revenue from rising commodity prices such as oil and gas. But don’t be mistaken – this budget spending is the highest in history (discounting two pandemic years) at $434 Billion, up by 6% per capita from 2020, the last non-pandemic budget. The Globe and Mail’s Andrew Coyne said the Liberals plan to spend more per capita in the next three years than any government in modern history. And he reminds us that budget projections generally understate what actually gets spent.

DOES THE BUDGET MAKE LIFE MORE AFFORDABLE FOR YOU?

Chances are, you will not find much, if any, relief in this budget.

Taxes are up.

- You will be paying more GST on everything as inflation forces up prices. The budget estimates that GST revenue will increase from $32.4 B last year to $54.7 B annually by 2026-27.

- You will be paying more carbon tax on home heating and transportation, plus the extra GST that is added to the carbon tax.

- The Parliamentary Budget Officer estimates that this year, the average Alberta household will pay $507 more in carbon tax than it receives in rebates. By 2030, that annual difference will go up to more than $2200.

- The carbon tax also increases the price of anything that has to travel to reach you – which is just about everything, including groceries, work inputs, and children’s needs.

- Businesses have to absorb the carbon tax on heating, transportation and supplies, with no rebates, so may have to pass the extra cost to customers.

- You may find your bank fees and insurance premiums going up. Scotiabank President Brian Porter has already said that big corporations will likely handle the new taxes (15% one-time “pandemic” tax on bank and insurance co. earnings over $1 Billion; and a permanent 1.5% increase in taxes on those companies on earnings over $100 million) by passing the cost to customers.

Who might benefit?

- If you are a young want-to-be first-time homeowner, you may benefit from a new savings instrument, the Tax Free First Home Savings Account, that will allow you to save up to $40,000 for a down payment. Contributions will be tax deductible (like an RRSP), earnings in the account and withdrawals used to purchase a home will not be taxed. The First Time Home Buyers Tax Credit doubles from $750 to $1500, and while every dollar helps, $1500 won’t go far in purchasing a home. I acknowledge this seems to match the doubling in house prices that has occurred over this government’s 7 year term.

- If you have children under 12, no dental plan, and earn less than $90,000, you may benefit when the government introduces dental insurance for children. Next year, they are projected to extend that insurance to seniors. Of course, here in Alberta, most lower or middle income seniors have automatic coverage from Blue Cross, so we’ll see if the federal initiative turns out to be an improved benefit. Beneficiaries in year 2 may also include older children up to age 18 and persons with disabilities.

- There is money targeted to low-income housing, but typically for this government, it is spread over several programs that will likely have narrow or overlapping criteria and administrative overload, so we’ll see if it actually results in new affordable housing being built. I hope it does. There is a one-time payment of $500 for those experiencing “housing affordability challenges” but it is hard to see how $500 will go very far, and the program will cost $473 Million. As an observation, the administration of this government’s housing policy – including through CMHC – is already too expensive, and has led to sub-par results.

- One of the housing programs might be of interest to Calgary Centre families: $7500 towards building a secondary suite intended for members of your extended family (the Multigenerational Home Renovation Tax Credit).

- If you are interested in being a health care provider in rural Canada, the budget will increase the maximum amount of forgivable Canada Student Loans by 50 per cent. This means up to $30,000 in loan forgiveness for nurses and up to $60,000 for doctors working in underserved rural or remote communities. The program starts in 2023-24.

- If you drink low-alcohol beer, the excise tax will be removed on July 1.

Other Spending Priorities in this Budget (over 5 years)

- $12.4 Billion in green energy subsidies and programs (targeted to electric vehicles and infrastructure, agriculture, and a CCUS tax credit which, unfortunately, excludes Enhanced Oil Recovery – see more below).

- $10.5 Billion toward reconciliation commitments

- $10.2 Billion toward the various housing subsidies and programs

- $9.4 Billion to defence, not specified what or when, but spread out over several years

- $7.1 Billion to health care, which includes $5.3 Billion for the new dental plan (over the next 5 years). The remainder is for pandemic surveillance, mental health and an effort to reduce the backlog for surgeries. There are no material increases to provinces to manage the post-COVID challenges.

- $6 Billion to “workforce initiatives” which include $4 B for immigration and refugee settlement, the rest for labour mobility, supporting foreign credential recognition in health, and improving the temporary foreign worker program

- $5.5 Billion to corporate subsidies and programs intended to spur economic growth (two agencies, The Canada Growth Fund and the Innovation and Investment Agency, will help fund or match private investment initiatives selected by government). Pay attention to this – because it seems like another government boondoggle to allocate taxpayer funds to pet projects.

- $3.8 Billion for the Canadian Critical Minerals Strategy, recognizing the potential of Canada’s mineral resources in helping the world move to a green economy.

- $1.7 Billion to fund a more gradual phase out from the small business tax rate as those businesses grow, which the government hopes will help eliminate barriers to sizing up.

Will the budget make a dent in the housing challenge?

Probably not much. As the Conference Board of Canada analyzes:

“The budget hopes to incentivize homebuilders to double housing starts in the next few years. This might be challenging. Volumes of units under construction are near record highs and builders are having difficulty finding workers. The Housing Accelerator Fund plans 100,000 new housing units over the next five years, but the average 20,000 units per year appears modest set against current annual 250,000-plus housing start volumes. The roughly 10,000 units promised by smaller plans like the Rapid Housing Initiative and the National Housing Co-investment Fund seem almost negligible. The same is true for plans to increase the volume of co-op housing by 6,000 units through a new Co-operative Housing Development Program. All told, budgetary measures seem unlikely to produce the starts ramp-up the government wants.”

So if you are looking for help in buying your first home or finding affordable accommodation, this budget offers only modest hope. The array of programs is far too complex, so the main beneficiaries are likely to be the bureaucrats trying to administer this maze.

Let’s recall the government’s last attempt at programming to assist with funding house purchases – the First Time Home Buyers Incentive. Administered by CMHC, it provided government investment as an equity partner on your home purchase. Of course, it missed the other costs of home ownership – so was really a program where the government was a preferred investor in your home – as an equity partner, not a loan. The program was so non-sensical, that the uptake on it was in the single digits!

THE HUGE MISSING OPPORTUNITY IN THE BUDGET – EOR

From the time I was first elected, I’ve been pushing for Canada to introduce a tax credit, similar to the 45Q provision in the U.S., to encourage Carbon Capture, Utilization and Storage. Where Canada was once a leader in this technology, the US is eating our lunch due to the unequal tax treatment. I introduced a Private Members Bill in the last Parliament – Liberals voted it down, saying they would introduce their own version.

Their own version arrived in this budget, but it excludes the most important opportunity: using waste carbon for Enhanced Oil Recovery.

Oil is often left over at the bottom of the well. It can be extracted by pumping compressed CO2 into the well, which flows the oil. The oil that is retrieved puts cleaner conventional oil into the overall mix: oil produced through CO2 EOR can be up to 60% lower in emissions than conventionally produced oil.

EOR projects also provide local jobs and generate royalties and taxes for provincial and federal governments.

And best of all, injecting waste carbon into old oil reservoirs means the waste carbon is stored forever in the now-empty reservoirs.

Finally, there is the environmental advantage of this technology. I acknowledge that decarbonizing our energy consumption will require a portfolio of technologies, but the most advanced of these is CCUS. Every study shows that

reaching our emissions reduction targets requires this solution. To ignore the environmental benefits that will occur as a result of the inclusion of EOR in the technology’s development means that the developments will happen more slowly and less economically – which means that we will be waiting longer to move to the decarbonization solutions the world needs.

EOR is a win-win-win, but the Liberals can’t see beyond their ideological hatred of oil.

In the House of Commons (prior to the budget), I asked the Minister of Natural Resources about his position on EOR:

My colleague Kyle Seeback, the Conservative Shadow Minister for the Environment, and I, also produced a detailed News Release after the Budget on why excluding EOR is a bad idea. Read the news release on my website.

BAY DU NORD (FINALLY) APPROVED BUT …

After the Bay du Nord approval, I was hosted by Evan Solomon on CTV Power Play along with an NDP colleague. While I am pleased Bay du Nord was finally approved, its long delay and 137 conditions is another example of how this government puts up roadblocks to investment, revenue and jobs.

Bay du Nord will supply lower emission oil product, and is well positioned to supply Europe in the future, helping them reduce their dependence on unreliable and environmentally irresponsible product that funnels money to despots. This is what Canada SHOULD be doing.

Here is the clip from my appearance on Power Play:

AROUND CALGARY CENTRE

Here are some pictures from my work around Calgary Centre.

I visited grade 3 students at Lycée Louis Pasteur School. I was grilled on the war in Ukraine, the NATO Alliance, Indigenous Residential Schools, and my job as a MP. What a bright bunch of kids!

I hosted an in-person Meet and Greet for residents of Killarney, Glengarry and immediate area. I do these neighbourhood consultations as often as I can, so watch for one coming up in your neighbourhood (we advertise on social media and you should also get a postcard invitation).

I took a walking tour of the west end with Farnaz Sadeghpour, President of the Downtown West Community Association. The bookstore is an intriguing combination of a ‘hipster’ bookstore (Sigla Books) and a coffeehouse (Loophole Coffee Bar). We stopped inside for a welcome break.

Please get in touch if there’s anything my office can do for you.

Greg McLean, M.P.

Calgary Centre

403-244-1880

Greg.McLean@parl.gc.ca

GregMcLeanMP.ca